|

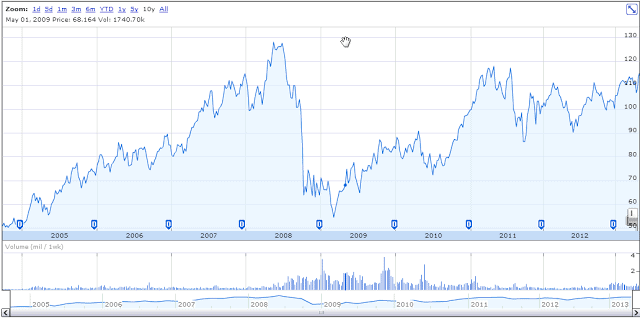

| Gas Price History from GasBuddy.com |

|

| Vanguard Energy ETF (VDE) History from Google Finance |

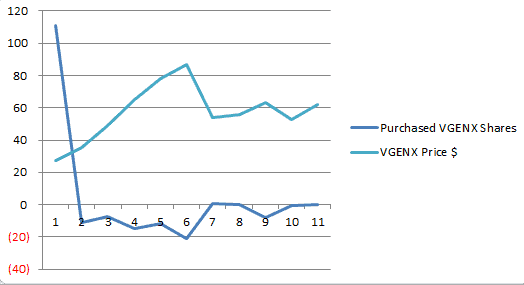

Fuel prices at the pump are highly correlated with energy sector index funds (which invest primarily in oil since that’s the way the energy market is weighted) so if you want to smooth out your fuel budget you can do your own fuel hedging!

I would use the Vanguard Energy fund for the low expense ratio, if you open up an account with Vanguard you can trade commission free. You have three options to buy this fund:

VDE (Vanguard Energy ETF) ER: 0.14% – no minimum

VGENX (Vanguard Energy Fund Investor Shares) 0.34% – $3,000 minimum

VGELX (Vanguard Energy Admiral Shares) 0.28% – $50,000 minimum (for those of you with large SUVs).

First, open up a General Savings Vanguard account and figure out which fund you want to invest in. If you don’t like trading on the market you’re better off with the mutual funds, but if you don’t have $3,000 to seed your mutual fund you’ll have to use the ETF or wait until you have $3,000. You don’t have to start with an initial value, but the more gas prices go up higher than anticipated the better it is to have more funding there. It’s best to start with an initial hedge of 2 to 3x your annual fuel budget.

From 2003 to 2013 gas prices rose roughly 10% per year, so we’ll count on that trend to continue. Set your current year’s fuel budget 10% higher than last year (obviously adjusting for any differences in how much you think you’ll drive) and follow these four simple steps:

- Once a year transfer any leftover money in your fuel budget to your Vanguard account and buy the Energy fund.

-

If you exceed your fuel budget, once a year or once a quarter sell enough shares of the Energy fund to cover the amount you’re over budget and transfer it into checking. Don’t sell any lots you haven’t held for at least a year so that you avoid paying capital gains tax.

-

If the market drops below your cost basis it’s time to do some tax-loss harvesting by exchanging it for a different fund (probably utilities) then exchange it back after 30 days. Use the loss to offset future gains on your taxes. If you have no gains to offset you can deduct up to $3,000 per year against regular income (check your particular tax situation first).

-

Set your fuel budget 10% higher for next year and repeat.

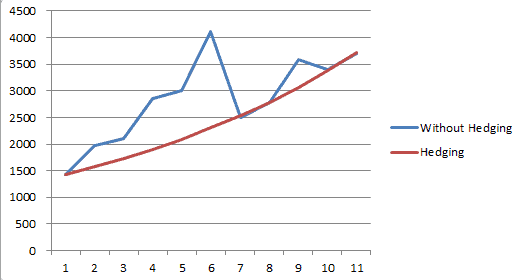

I ran the numbers as if someone who consumes 1000 gallons of fuel annually started doing this in 2003. With a $3000 initial seed into his Energy fund. How did he do? He would come out $4252 ahead (excluding taxes), saving roughly $425 per year on fuel in addition to the benefits of having a predictable fuel budget (hedging paid for $1920 of his fuel costs).

So why does this work? Because Fuel and Oil company values are correlated it forces you to buy when the market is lower (and your price of gas goes down) and sell when the market is higher (and the price of gas goes up). You are in effect putting in place an investment strategy developed by Michael Edelson called Value Averaging. This is different than Dollar Cost Averaging where you put the same amount of dollars in regardless of the market, Value Averaging amplifies the affect. Of course, there’s no guarantee it will always work.

And the end result is you have predictable fuel costs…

Disclaimer: I don’t hedge fuel prices myself, but I don’t even fill up once a month.