A couple of people have asked how I keep track of Health Savings Account (HSA) transactions; so here’s how I do it in Quicken.

Quick summery of HSA Accounts: Health Savings Accounts are a way to save for health expenses if you have an HSA eligible (HDHP) health insurance plan. I always maximize our family’s annual HSA contribution even if I can’t afford to do so. I’d take on debt before not maxing out an HSA because HSA’s have a triple tax advantage:

1. Contributions reduce taxable income.

2. Earnings grow tax-free (and can be invested in funds such as the S&P 500)

3. Withdrawals are tax-free when used for medical expenses.

See: Why You Should Consider an HSA Even if you are not rich.

But you do need to keep good records. In Quicken, there are a few ways to accomplish this. Here’s my way (which is the right way):

Create the following accounts in Quicken:

“Fidelity HSA”, “AR HSA”, “AP HSA Liability”.

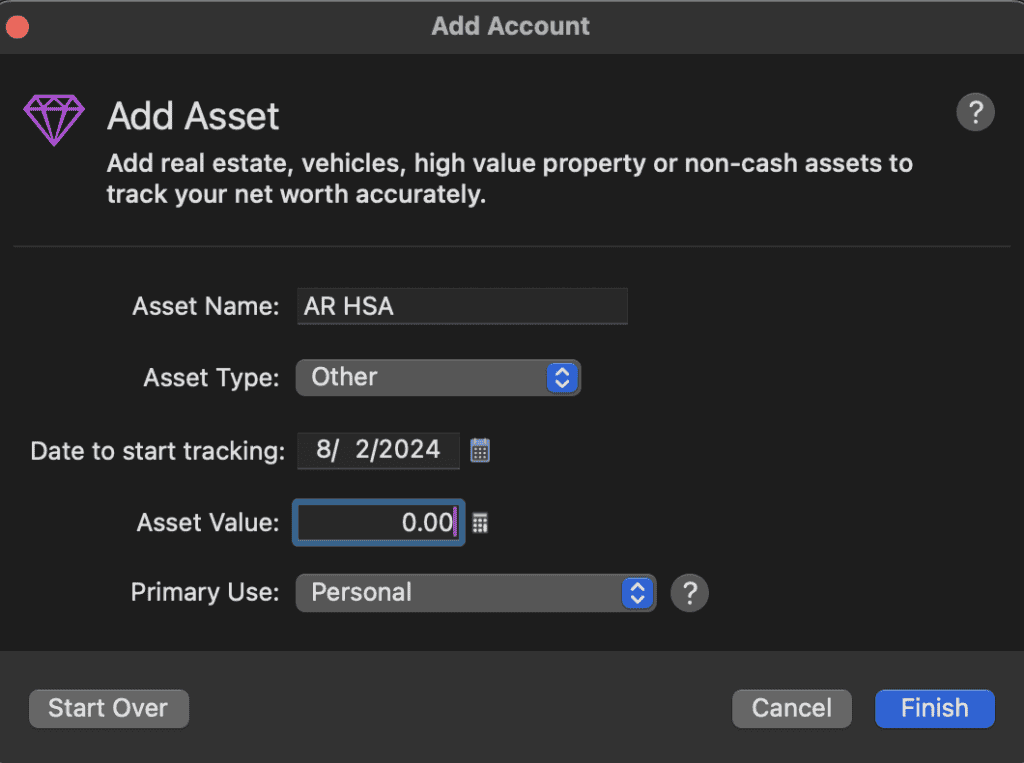

AR = Accounts Receivable (asset account)

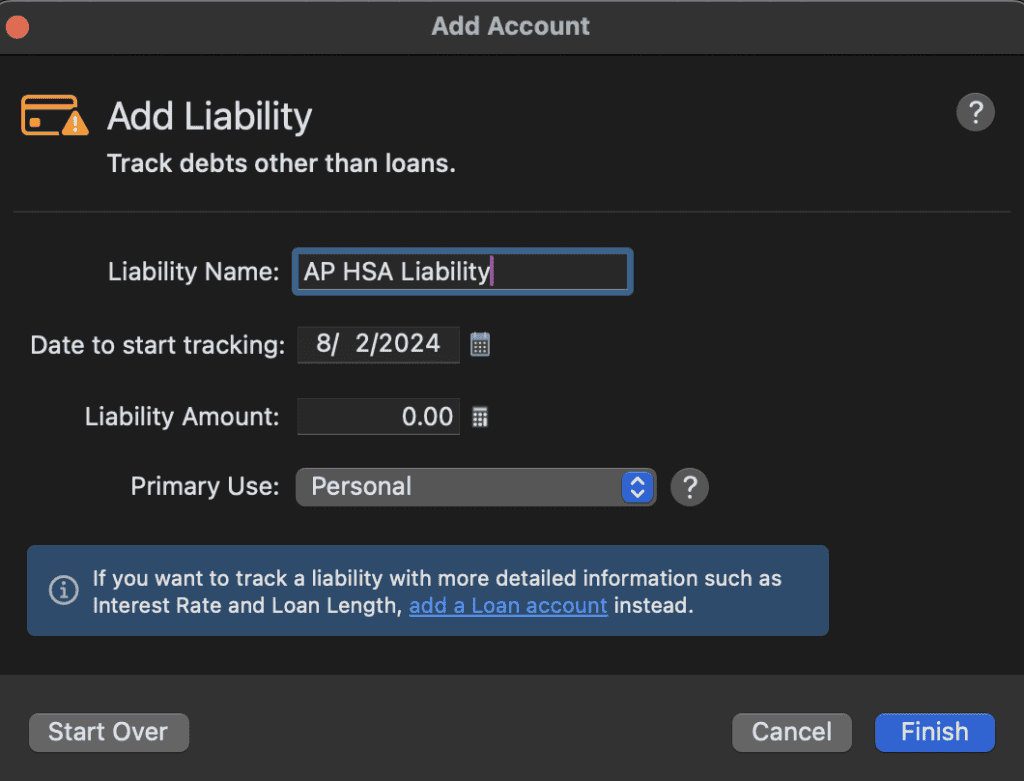

AP = Accounts Payable (liability account).

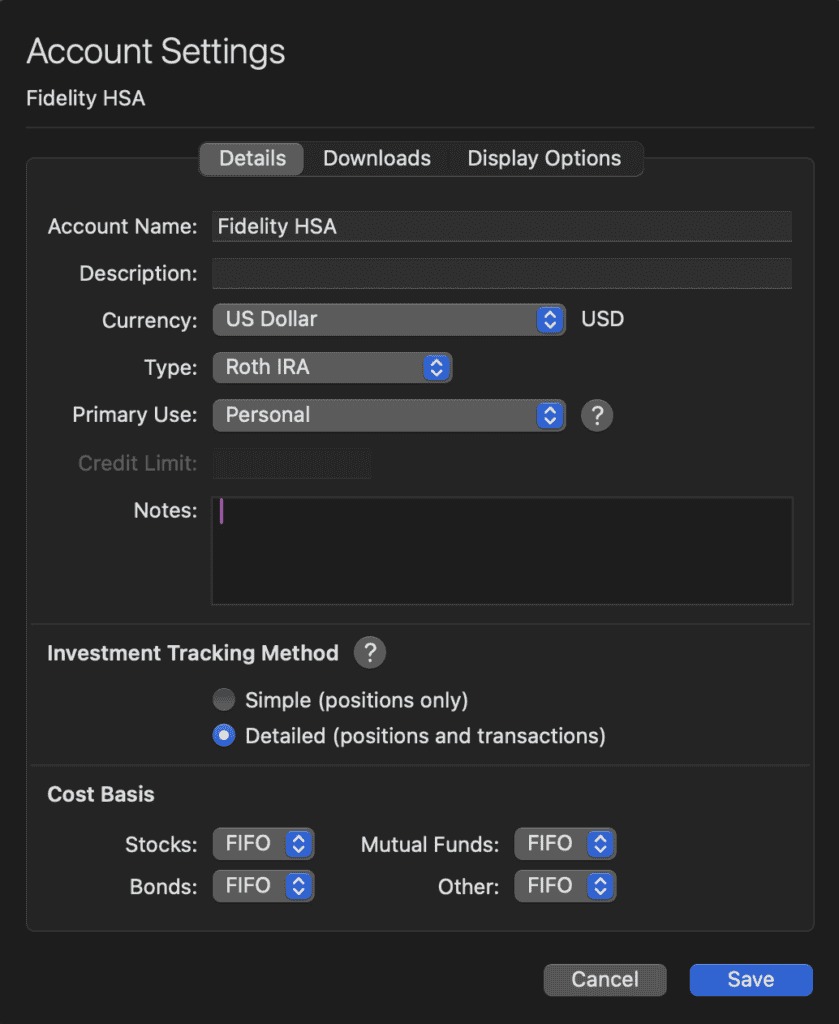

- [Fidelity HSA] – This is the physical HSA account, I used Fidelity as an example because their HSA offering is widely regarded as the best option. Unfortunately Quicken does not have an HSA Account type (Quicken team: please add this!), but it is a brokerage account that can behave like a retirement account, and when used properly probably behaves most like a Roth, so I set the type to Roth IRA.

- [AR HSA] – This is used as an asset account. This is how much I’m allowed to collect from the HSA. I’ll debit this whenever I make an eligible HSA expense and credit it when I reimburse myself. The balance is how much I’m allowed to withdraw without tax penalties.

Note your eligible medical expenses may exceed your HSA balance–that’s okay because you can apply the expenses against future growth and contributions.

- [AP HSA Liability] – This is a liability account that mirrors the [AR HSA] asset account. This is necessary because Quicken is a double-entry accounting system behind the scenes. It seems weird that you need a mirrored account, but this is the correct way to set it up. It is true that [AR HSA] is a receivable but you owe it to yourself, meaning it needs an offsetting liability. Don’t blame me, I’m not an accountant. 🤷♂️

Entering HSA Transactions

So–let’s say I go to the doctor and insurance covers most of it (haha). The portion that insurance covers is not eligible for HSA reimbursement. But I get a $5,000 bill that’s my portion to pay. First check Publication 969 and Publication 502 (by the time you read this, all the publication numbers and rules may have changed so do your own research) to make sure the medical expense is an eligible medical expense. If not, though beans 🫘.

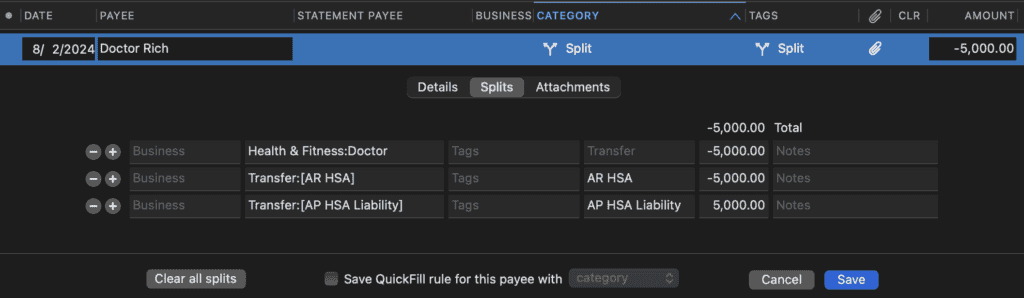

But if it is eligible, I pay the doctor like normal, credit my Doctor expense category like normal. But I also split the transaction to track how much I’m allowed to withdraw from the HSA to reimburse myself later. Let’s say I pay the doctor from my Credit Card account (which we usually do since we can range anywhere from 2.5-4% cash back–$200 may not seem like much on a $5K transaction but we’ll take it!); I’ll create a split transaction with the following entries:

* Credit Card Account (Payment to Doctor): -$5,000

* Health & Fitness:Doctor: -$5,000.00

* TXFR:[AR HSA]: -$5,000.00

* TXFR:[AP HSA Liability]: $5,000.00

HSA accounts require good record-keeping. I write the paid date on the paper medical bill, scan it into a PDF using our ScanSnap (Amazon), and then attach the PDF to the Quicken transaction–and keep another copy in DEVONthink. My health insurance always requires medical codes to reimburse us, so I assume the IRS would want to see the same thing if they audited us. 90% of our bills have the codes on them already, but I learned some providers are unwilling to give us the medical codes. But I have a simple trick to get the codes: I withhold payment as leverage; then somehow, they always find a way to produce the codes!

Now, in Quicken you can look at the [AR HSA] asset balance, $5,000, and whatever is there is how much you’re allowed to withdraw from your HSA Account. You can take it out now, or leave it in and continue to let it grow. You’ll also see a negative $5,000 balance on [AP HSA Liability] which is how much you owe yourself.

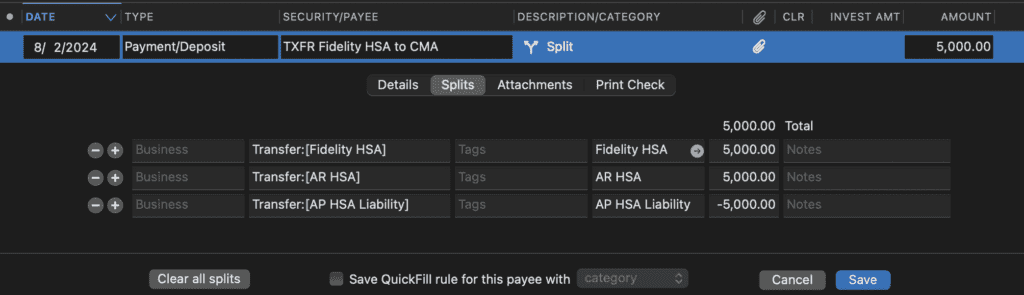

Whenever you decide to reimburse yourself, you simply do the reverse, but instead of the payee being your doctor, it’s your HSA Account. Here’s what it would look like on your Checking Account receiving an HSA Reimbursement:

* Checking Account (Deposit from Payee): $5,000

* TXFR:[Fidelity HSA] $5,000.00

* TXFR:[AR HSA]: $5,000.00

* TXFR:[AP HSA Liability]: -$5,000.00

You’ll note this doesn’t actually hit any expense accounts, and that’s expected. As far as you’re concerned nothing impacted your net worth.

With this method you can use Quicken to keep accurate records and quickly see how much you have available to reimburse yourself from your HSA at any moment in time.

The same method can be used with similar accounts such as state MSAs (Medical Savings Accounts).

It seems like a lot of work, and it is, but the tax savings is well worth the effort.

This is the best example of HSA transaction tracking I’ve seen. Thank you for posting!

How do you handle the tracking of qualified medical mileage expenses without affecting Quicken’s net worth calculation? Since there isn’t an initial outflow of money from an account like a payment has, I haven’t quite been able to figure it out,

Also, I’m a big fan of Fidelity!

Thanks again.

Thanks, Jacob. You’re welcome! So–for 2024 I just tracked it in Excel. We had our first 2025 medical trip yesterday, so I put it in Quicken for this year. Quicken released an update for Mac this morning so I don’t know if this is new behavior or not, but I can go to Business (which is an odd place to put it), New Trip, Trip Type -> Personal, Purpose -> Medical. It sets a rate of $0.21/mile and doesn’t impact net worth.

I already have an account set up for my HSA in Fidelity. There are two securities in there and a cash account. If I use my HSA card to pay for a doctor visit, how would I record that in Quicken? I have set up the AP and AR accounts as you suggested.

In that case I don’t think you would need to do anything special because your HSA is reimbursing yourself for the expense immediately. I’d just categorize it as doctor and be done with it. I’d prefer to delay reimbursing myself to take advantage of tax free investment growth in the HSA which is why I’m doing what I’m doing.

In Quicken I have my Fidelity HSA account (set up for download), AR HSA and AP HSA Liability accounts set up. To record a HSA debit card transaction, which account would I use?