Sadly, my favorite credit card, the Schwab 2% Cash Back (and no foreign transaction fees) is being discontinued. I loved being able to get a straight 2% back on everything without being concerned about which card I was using… so time to re-consider our credit card strategy.

We already have the Costco Amex and Amazon Visa (we buy a lot of stuff from Amazon) which give us cash back in the following categories:

Costco Amex

I was thinking about getting this card since groceries is one of our highest budget lines (even after considering the groceries purchased at Amazon):

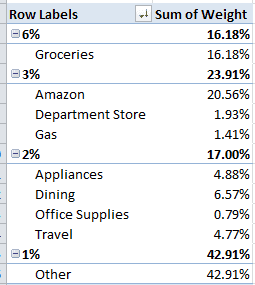

To see if the above three cards can beat my previous 2% back strategy I ran a PivotTable against my Quicken credit card data to get spending by payee then added what I guessed the merchant would be categorized as. Here are the results:

6/1/2011 to 10/18/2011 (since we moved to Idaho and had a bit of time to settle in until now).

|

| “Row Labels” should be “% Cash Back” and “Sum of Weight” should be “% weighted average of spending” |

So looking at the data to the left you can see using those three cards we would do quite well. 16% of our spending would get 6% cash back, 24% would get 3% cash back and so on.

Using the cards strategically we would get a weighted average of 2.45% back. That beats out 2% by a fair margin.

Now the “Other” 1% is a large chunk, lets see what we can do about it…

The two good 2% on everything cards left on the market are the Fidelity Amex (2% into your Fidelity account), and the Capital One Venture card. If I turned that last 43% into 2% cash back we would get a weighted average return of 2.89%. Not bad.

One thing I’m not sure of, is how accurate American Express’ categorization is… I had the Chase Freedom Visa which was supposed to give us 3% in the top 6 categories but since they didn’t categorize all the stores we only got back 1.32% which prompted me to use the Charles Schwab card. But I’m going to see if American Express does any better (so far our main Supermarket is classified as a Grocery store, our local Wal-Mart is not, but that’s to be expected). If it turns out we really do beat 2% I’ll stay with that strategy, otherwise we’ll go back to a flat 2% back card.

Nerdwallet is a great site to find the best rewards you can get based on the type of spending you do.

(sorry about the paragraph spacing being off, Google updated their blog editor and it doesn’t obey line breaks the way I’m used to…)