On June 5th, 2021, I posted a strategy to hold value against inflation which was holding positions in four asset classes: (1) Total Stock Market, (2) I-Bonds, (3) Home Ownership, and (4) Bitcoin.

Results June 3rd 2021 to June 1st 2024

This is a 3-year check-in (156 Weeks).

Please note that due to inflation, I’ve adjusted most of the Growth of $10,000 examples to $100,000.

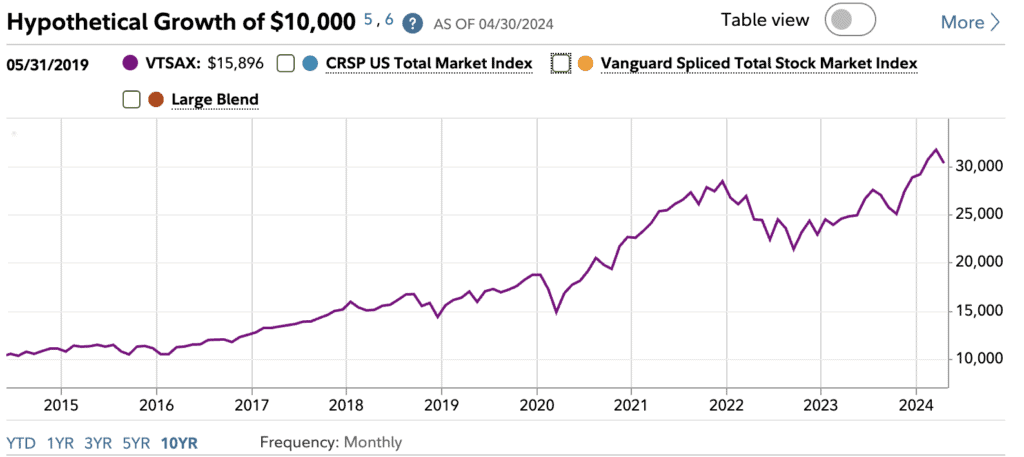

Total Stock Market

Certain people seem to have a perpetual pessimism about the market. The other day a colleague told me the Stock Market performance has been terrible since Covid. I have no idea what he’s talking about.

Between June 3rd of 2021 and today (June 1st of 2024) a $100,000 investment in the US Total Stock Market (VTI – Vanguard Total Stock Market Fund) would have grown into $119,270 (includes reinvested dividends). A 19% increase.

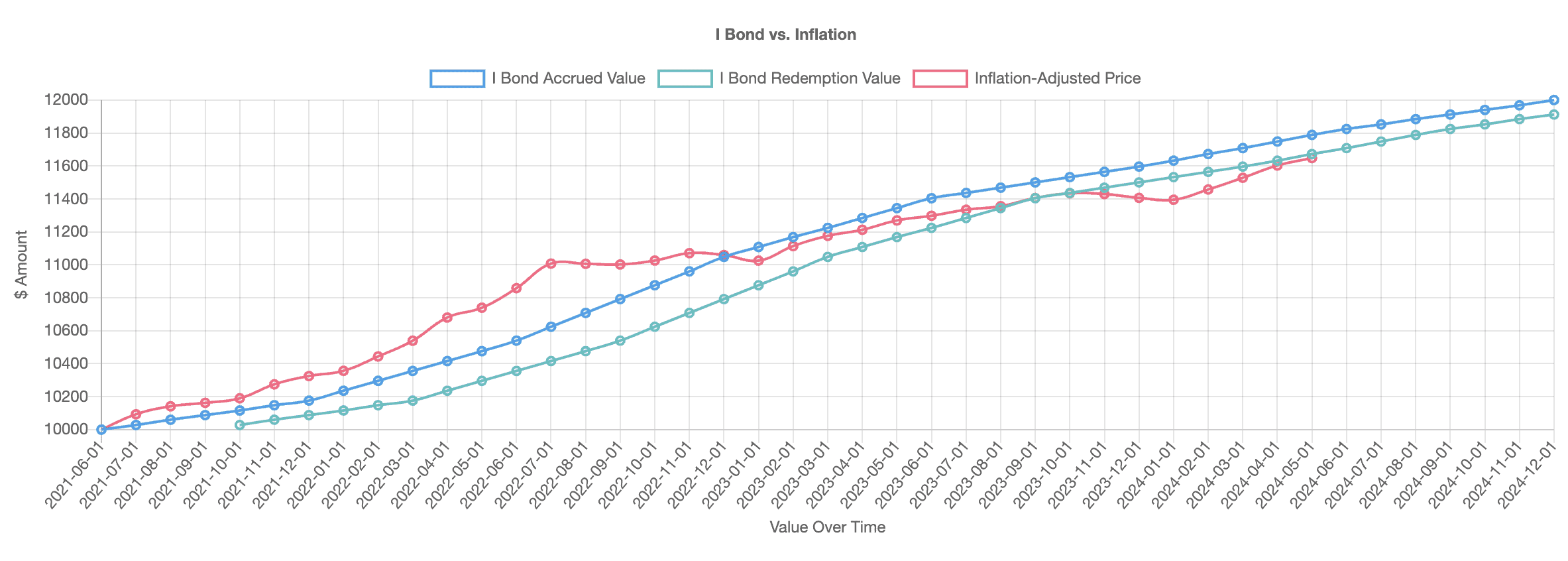

I-Bonds, T-Bills, and MMFs

It is amazing people still hold cash in bank accounts yielding nothing.

$100,000 savings in I-Bonds would have turned into $117,880. An 18% increase. I should note this nearly kept up with the Stock Market and I-Bonds don’t lose value when rates go up. Now getting $100,000 into I-Bonds would be difficult with the $10,000 per entity ($20,000 for a couple) per year purchase limit. But 1-month Treasuries have been yielding 5.5%. Money Market Fund or Treasury ETFs like VMFXX and USFR are an easy way to stay on top of high yields.

Home Ownership

A $100,000 home investment would be worth about $146,100 in the North Idaho area (your area may vary). A 46% increase. This option is a bit less appealing now with higher mortgage rates. However, I don’t think the mortgage rates are terrible. When the rates were 3% they were essentially free loans against inflation, and now with higher inflation and rates at 7%, they’re still nearly free. The interest you pay on a mortgage is about the same rate that the USD loses value.

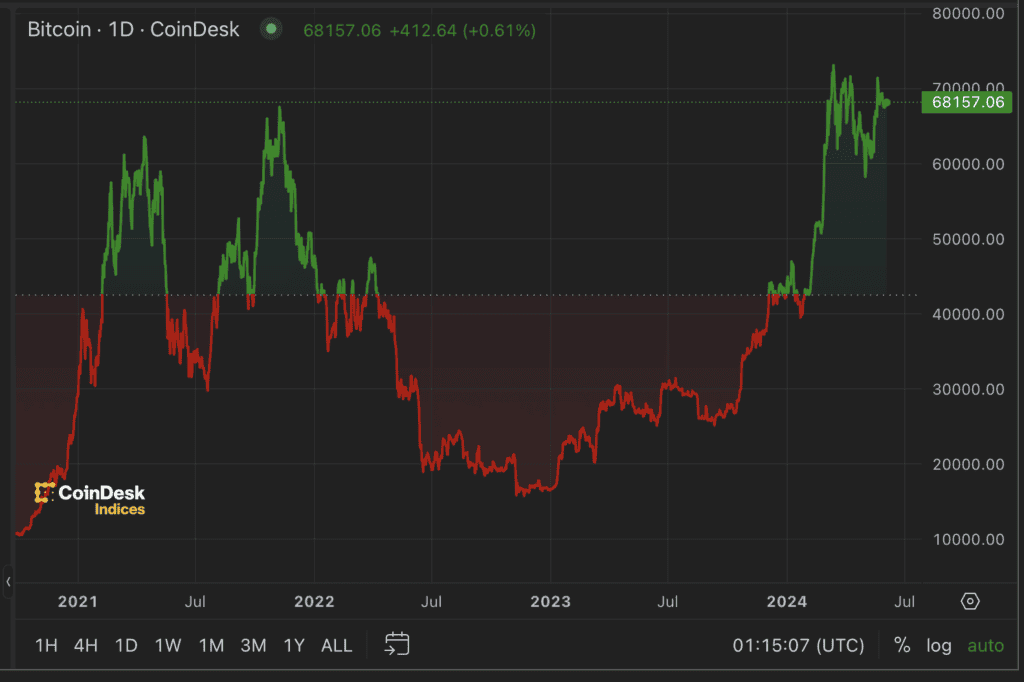

Bitcoin

A $100,000 savings in Bitcoin would now be worth $190,530. A 90% increase. Now Bitcoin ETFs such as FBTC – Fidelity Wise Origin Bitcoin Fund make it pretty easy to save in Bitcoin.

Bitcoin is volatile and still a highly speculative asset class. It requires nerves of steel to not sell it when it falls–and it has seen significant volatility against the USD.

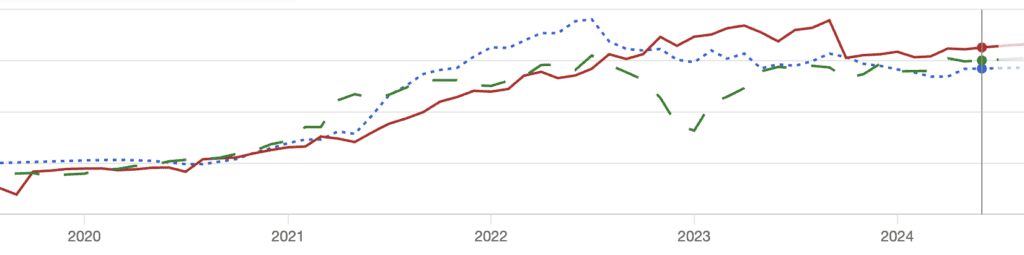

Comparing the Portfolio Against Inflation

2 Kings 6:25b — And behold, they besieged it, until a donkey’s head was sold for eighty shekels of silver, and a fourth of a kab of dove’s dung for five shekels of silver.

Let’s say you invested $100,000 split evenly between the four assets; after 3-years you’d have $143,450. A 43% increase. Now let’s compare this to inflation:

CPI – Consumer Price Index. Looking from April 2021 to April of 2024 (June 2024 isn’t available yet) the dollar lost 15% of it’s purchasing power. I’m not sure CPI is a good indicator of inflation, but we can say the portfolio held well against the CPI.

Big Mac Index – a Big Mac in the United States went from $4.89 in Dec 2020 to $5.69 Dec 2023 (June data isn’t available yet) according to the Big Mac index, an increase of 16%. Had you kept $100,000 in no-yield FDIC savings accounts your Big Mac purchasing power would have dropped from 20,250 to 17,560! The portfolio not only held but increased purchasing power to 25,000 Big Macs.

Home Prices – The Portfolio did well against home inflation where I live. 46% inflation vs 43% home price increase. One would still have 98% purchasing power.

Beating Inflation Portfolio

- Total Stock Market

- I-Bonds, Money Market Funds or Short-Term Treasuries

- Home Ownership

- Bitcoin (if you have nerves of steel).

What is the long long-term cost of doing nothing? A $100,000 in a bank account earning nothing would lose around 15% of it’s purchasing power over 3-years. Over the long-term, the USD value becomes worthless. To hold USD over long periods of time is also a risk.

Any of these portfolio components could lose their value, in fact there are times this portfolio was negative against holding USD. But as we zoom out over a decade it hypothetically could continue to bear well against long-term risk at the cost of high short-term risk. The hope is that it will continue to beat inflation but there’s no guarantee. I don’t know the future. Nobody does except God who formed it.

Isaiah 46:10-11 LSB –

Declaring the end from the beginning,

And from ancient times things which have not been done,

Saying, ‘My counsel will be established,

And I will accomplish all My good pleasure’,

Calling a bird of prey from the east,

The man of My counsel from a far country.

Truly I have spoken; truly I will bring it to pass.

I have formed it, surely I will do it.

This post is for informational purposes only and does not constitute financial or other advice.

Interesting info overall. Bitcoin being the high performer definitely holds true with the “high rewards come from high risk” sort of directive, and that could turn into significant LOSSES very quickly at any time.

The home investment item, for me, is pretty meaningless for a variety of reasons. The only way that you can generally use a house as an “investment” vehicle overall is to basically pay cash. Anything less, including when interest rates are low, still requires regular payments towards “managing” that investment due to a large portion of the payments in the beginning being put towards interest (which you don’t recover). The other side of this is that turning equity into cash means HELOC or equity loan, both of which require borrowing against the asset at then-current rates. To have paid $100k into an asset only to take it back out when interest rates are 3x what they were at the time of purchase would be poor investment strategy. The option to SELL that asset to realize the gains has become much more difficult due to interest rates for current buyers being so much higher.

It’s also worth noting that buying a house in 2021 would almost certainly NOT have been done as cash except possibly to get the deal closed before doing a refinance out afterward. When the cost to borrow is low, investors don’t tie up cash like that.

The thing that I have learned over time is that, while your home is your single largest asset, it really is NOT an investment. After you account for the total cost of owning the house with taxes, insurance, upkeep, repairs, etc. – breaking even is actually sometimes hard to do. My last house lost about 10% in value over ten years (I bought it in 2010) and that doesn’t account for any of the money I put into it which was considerable just for operating costs and taxes.

Good points, Mark. It’s good to consider the other side of this–particularly the cost of maintenance and the risk that home prices don’t always increase in every area. I also see home ownership primarily providing stability for the family so in some ways its primary purpose isn’t an investment.

An Excellent breakdown. I am curious if it will hold through the next change. CBDC adoption will likely change a lot of this. I still think this is a reasonable strategy though.

Thanks, Adam. Yeah, it will be interesting to see how CBDC changes things. I’m guessing CBDC won’t have a fixed-supply.