The hamburger to dollar ratio is getting smaller. While one can never know the future, it appears inflation is upon us.

Here are some quick ideas to protect the number of future burgers you can purchase.

How Not to Beat Inflation

First, some things that won’t help.

- Whine about inflation. It’s sort of like the people who complain about the weather being too hot while living in an air-conditioned home, driving an air-conditioned car, and working in an air-conditioned building. You can complain all you want, but it won’t be as effective as adjusting the thermostat.

- Hold your money in cash. By cash, I mean FDIC-insured checking/savings accounts. Now, aside from gambling, a checking or savings account is about the surest way to lose your purchasing power, a few percentage points per year until it’s worth a single french fry. In the short term, cash is a great place to prevent loss. So it is good to have some money in cash if you need it in under a year…. but long term, it’s terrible.

- Timing the market to get rich quickly. Trying to chase returns and timing the stock, bond, or cryptocurrency markets at just the right moment rarely works. Instead, invest early and often, consistently. That will make a difference over the course of a lifetime.

Ideas to Protect Your Hamburger Purchasing Power

(Keep in mind these aren’t guaranteed to work)

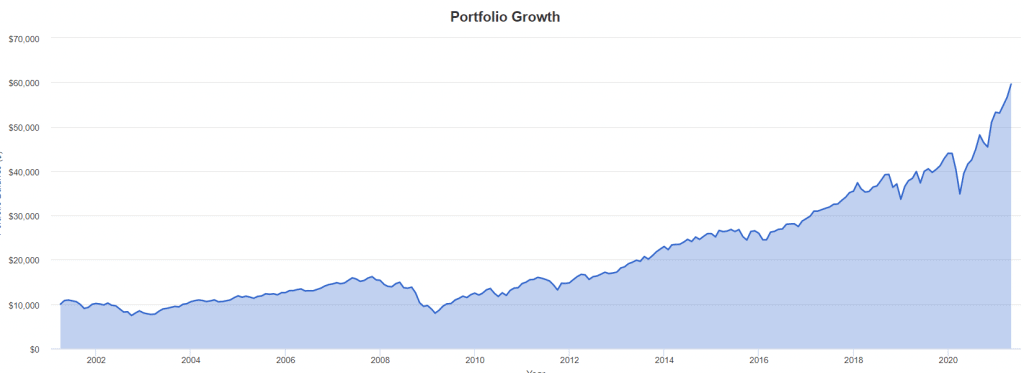

Total Stock Market. While the stock market is volatile, it has historically been a great instrument to protect against inflation by increasing purchasing power over long periods–this comes at risk (you could lose it all) and, most certainly, short-term losses. You have to have nerves of steel not to sell during market downturns. If you had put $10,000 into the Vanguard Total Stock Market (VTSAX) in April of 2001 and had the discipline to not sell during market downturns, you’d have $59,585 in April of 2021 (inflation-adjusted to $39,314). A 4x real gain.

I-Bonds. I-Bonds are unique. Unlike most bonds, they can’t drop below face value when interest rates rise. I-Bonds are issued at 0% interest today, but they also have a component that tracks inflation. The inflation component is now yielding 3.54%. That’s a great deal for something as safe as a U.S. Government Bond. I-Bonds provide a much better rate of return. You need to hold I-Bonds for a year before redemption and ideally 5-years to avoid an interest penalty. There’s also a $10,000/year per person investment limit.

Home Ownership. This is a hot market, so I’m not suggesting this is a great time to buy a house, but owning a home has historically been an excellent hedge against inflation. Aside from the freedom and stability of owning a home, you can think of homeownership as locking in your housing expenses for the long-run. I’ve never lived in an area where it’s cheaper to rent than to buy–and at the end of 15 or 30-years you end up with a house and don’t have to pay rent anymore. With interest rates in the 3% range, it’s essentially a free loan. The housing market can swing wildly, but those who hold for a decade or longer generally come out ahead of renters. Try to buy something that would be appealing to others in case you need to sell later–traditional construction, a well-done layout, and a good location mean it’s less likely to depreciate over the long run.

Gifts. This would be an excellent time to give your family, a neighbor, or a charity a gift. Let’s say you’re planning to give a $1,000. Today it’s worth $1,000. A year from now that amount will be worth less. Chances are the recipient will spend the gift now so it’s more valuable to give today than tomorrow. Maybe they would use the money or property now before losing its value to inflation.

BitCoin? What about Cryptocurrency… It isn’t strongly tied to the USD so has some chance of hedging against inflation if you could stomach the wild ride. It has some unique benefits and risks. I can’t claim to know its future. There are risks with Cryptocurrency. It wildly fluctuates, a lot of people lose their digital wallet or forget their password to unlock it, and there is no financial institution to call and no possibility of recourse if something goes wrong with a transaction. That said cryptocurrency may provide a hedge against inflation similar to Gold or commodities. It’s a very risky option, but it’s there.

There you have it: Stock Market, I-Bonds, Home Ownership, and Giving.

Do not toil to acquire wealth;

Proverbs 23:4-5

be discerning enough to desist.

When your eyes light on it, it is gone,

for suddenly it sprouts wings,

flying like an eagle toward heaven.

Good content, Ben. As you likely know, finance is a topic that’s important to me as well.

One of your points focuses on home ownership. I bought a home in 2000 right at the beginning of the upswing in the market and sold it in 2007 as things were at about their peak. I couldn’t have asked for a better alignment from a financial point. I invested a -lot- of money into the home with all new windows, new siding, and a significant remodel of a few rooms, and I did all of the work myself. After paying off the original mortgage/cost for the house and the materials costs, there was an increase in value of about $90k. After paying all of the fees to sell the house, there was a nice ‘profit’ from my sweat equity.

I bought my current home in 2010, well after the housing bubble had burst. Eleven years later, I am looking to sell into a hot market and stand to actually lose money but I also invested very, very little into the house.

It’s a crap shoot.

Mark, even with a loss I’d be curious if you still come out ahead of renting? (e.g., if you would have spent $1,000/month to rent a comparable house for 11 years, you’d need to lose more than $132,000 on your sale for it to be worse off than renting… of course that’s ignoring interest expense if you took out a mortgage or lost investing opportunity if you didn’t).

It isn’t that simple, though.

Assume you want to buy a $200,000 home and need to put 20% down on the mortgage at the time you buy. That means that you have $40,000 in the bank for the downpayment. Assume that all of the ‘additional’ monies that the mortgage company wants you to have is available in areas like retirement accounts and not in your savings account.

Assume a 30 year mortgage for that home and your principle and interest will be around $800/month. Add in your property taxes and insurance, and you’re likely to be around $1200/month.

Live in the home for ten years and sell it for the same amount you bought it for. For the sake of simplicity, we’ll assume you still owe $125,000 on the loan balance at that time. After you deduct out the various realtor fees (6%) and such (let’s assume 7% total costs) associated with selling the home, the $200,000 is reduced to $186,000. Subtract the loan balance and you walk away with $61,000 to put in the bank.

Let’s look at the renting side… Assume that you will rent a place for $1000/month and there will be NO increase in rent over the same ten years. That’s $120,000 in rent that has been paid out. But…

Your original $40,000 is still in the bank (or invested) and earning interest. PLUS, you’re adding $200/month to that balance. At the end of ten years, assuming a constant 1%APY, you’d have $70,000 in the bank. If you are able to earn at a higher yield, like 4%APY, you’d end up with over $88,000 in the bank.

Of course, this is over-simplified math and skips important things like increases in rent and increases in property taxes. It also glosses over additional costs of home ownership like the money required to keep up the property which is not required (or not as significant) in the case of renting.

So, selling a home for a loss is a pure loss (in this example) compared to renting no matter the amount.