|

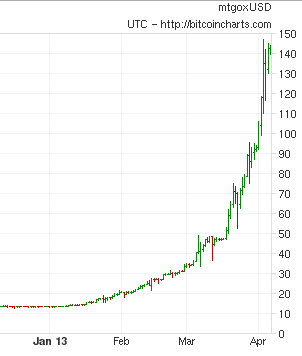

| Source: Bitcoin Charts, April 5, 2013 |

I learned to recognize bubbles from William Bernstein’s short history of bubbles in the The Four Pillars of Investing… here are a few, along with some more I found on Wikipedia…

- Tulip Craze

- South Sea Company

- Mississippi Company

- Railway Mania

- Florida Land Boom

- Stock Market Bubble

- Poseidon Mining Bubble

- Japanese Bubble

- Asian Bubble

- Dot-Com Bubble

- Uranium Bubble

- U.S. Housing Bubble

2013. BitCoin Bubble?

I like the idea of the Bitcoin currency, and it certainly does have an advantage that nobody can just print it so normally it should hold it’s value because it should maintain it’s rarity. People are looking for alternatives to their local currency. People are afraid because of situations like Cyprus where your money is confiscated, or the United States where your government is so far into debt you don’t see an outcome where devaluing of the dollar doesn’t occur. So people start buying Bitcoins, which drives the price up (supply and demand), and now everyone is seeing the value of Bitcoins rise so it becomes a speculative investment just like Tulips or Real Estate. Bitcoins will go much higher in value than they’re worth and at some point when someone realizes they’re not worth that much everyone will try to get out. Bitcoins may go up to $200 then crash or may go up to $1,000 or higher then crash. But, with near certainty at some point in the future it will come crashing down in value overnight. Of course, I could be wrong.

I was actually reading about this just the other day. It’s a very intriguing idea but it does have its problems.

The two biggest to me seem to be that it has nothing backing it as a currency and that it is too rare to keep up with demand.

I’ve heard that the dollar could be worthless in a day the second we stop believing in it, but it’s more than that. People believe in the United States (whether they should or not is a different discussion) and that the money they print will be redeemed by them when asked. Now that is a precarious balance since the United States has no chance of being able to redeem every dollar in its economy right now, but it in theory has enough to trade if a portion of the people suddenly decide to do that. Bitcoin has nothing like that even remotely. There is no one backing it as a currency. It’s only value is its rarity.

But that is also a problem since it is so rare that it experiences such wild swings, such as the current one (which is probably a bubble). It also has been experiencing deflation, which means, yes it goes up in value over time, but that means no one wants to trade it. It is part of what is making the bubble. It is expected to go up in value over time so its more valuable now… so people don’t want to trade it away now.

All that though, I think it is an interesting experiment and I am looking forward to how it turns out.

My preferred currency is 12gauge and .22 rimfire.