How to shop for mortgages and pay your mortgage off early.

Noelle Asks:

Hey Ben! Do you have any resources/advice for finding a good mortgage lender?

Hi, Noelle.

Here are 9 Tips for finding mortgage lenders

1. Compare Mortgage Options

Even if you don’t use them, the AimLoan.com website will let you compare various scenarios without you giving your information or doing a credit check. No other broker will get you information like this ahead of time. You can see all your options and decide what you like best.

It’s basically a game of (a) interest rate, (b) closing costs/points/loan fees, and (c) loan duration. From my experience, it takes most brokers forever to run each scenario, and many are just salesmen, so it’s better to learn what you want using AimLoan before talking to anyone.

Update (Thanks for pointing this out, Preston): When comparing quotes, watch out for the trick of giving you a “lower” rate by increasing closing costs. Often this is rolled into the loan, so it’s not easily noticeable.

On my last refinance, I was able to determine from playing around in AimLoan that I was getting a horrible deal because my mortgage was too small. I found out that bumping the loan amount by a small amount (which I could do with a cash-out refi) bumped us to the next threshold, which got us a much better rate.

2. Maintain Flexibility

My general rule is “I don’t know the future,” so I try to pay as little today as possible and give myself flexibility in the future.

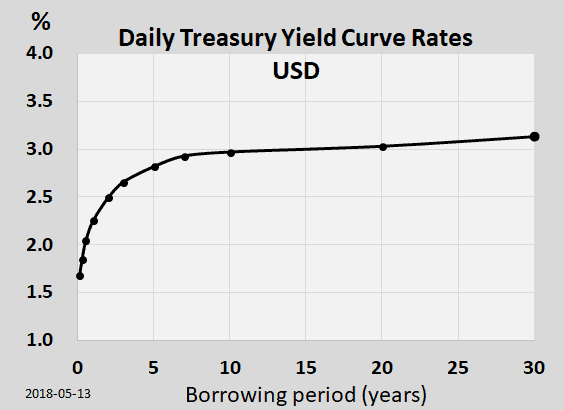

Look at the yield curve.

If the curve is flat like that, there’s no reason to get a 15 over a 30. Even if I plan to pay off the house faster, I still prefer a 30-year in case of unpredictable financial hardship.

💡Most people don’t know paying off a 30-year loan is faster than a 15-year. I’ll show you how to do this in step 6.

Also, I’d prefer a 5% interest rate and no points/lower closing cost over a 4% interest rate with more points / high closing costs.

The entire point of a loan is that you don’t have money now; it’s ridiculous to buy points. I would not advise buying points. You probably shouldn’t buy points. I do not think it wise to buy points.

I usually tell the mortgage broker if I am to buy points or pay closing costs; I want a 3-year ROI (return on investment). The reason is if interest rates drop, you want the option to do a zero-cost refinance at will without feeling bad about wasting all those points/closing costs you spent to get your rate down.

3. Do Multiple Hard Credit Pulls within 14 Days

To shop rates, you can have multiple mortgage lenders do a hard pull on your credit within 14 days of each other, and it will only count as one pull on your credit score (be aware that there can be a few days slack, so try to get them all to do it the same week). Having 2 or 3 comparisons is wise.

4. Ask Friends and Family for Referrals

Ask your real estate agent for a good place to finance (and ask your local friends for a good agent). There’s sometimes an advantage to using a local lender–they know the area, and the loan may be less likely to fall through if they also do the financing. Credit Unions can be good. Otherwise, I’ve gotten good quotes from Schwab/Rocket Mortgage, AimLoan, and Better (it’s a good idea to get a quote from one of these to keep your local lender honest). Also, I’d ask your friends in the area who they went with and if they liked them. You can often negotiate by getting a lender to match a better quote.

5. Get rid of PMI as soon as you can

If you can’t put 20% down, chances are you’ll have to pay PMI (Private Mortgage Insurance). You’ll want to get rid of that ASAP. As soon as you have enough equity or cash to put down 20% you’ll want to refinance (another reason not to pay more for points and closing costs) into a conventional loan to get rid of PMI. One exception is if interest rates go up, you may find it cheaper to keep PMI than to refinance.

6. The Fastest Way to Pay off a Mortgage Early

When you finally get a house, and you’ve gotten rid of PMI, the fastest low-risk way to pay off a mortgage early is not to pay your loan off early. Instead, take the extra you would have put towards your mortgage and buy I-Bonds (you can buy $10K/year; and so can your husband totaling $20K/year). The current I-Bond rate is 9.62%. Unlike typical bonds, I-Bonds do not lose value when interest rates rise. So if the rate rises, just buy more I-Bonds as you can afford to. If the rate ever falls below your mortgage rate, then sell your I-Bonds and proceed to pay the mortgage down instead.

Using a 30-year mortgage + I-Bonds will usually allow you to pay off your house about 18 months sooner (depending on current rates and the yield curve) than a 15-year mortgage.

There is a risk of U.S. Government default (unlikely but could happen).

7. See if you qualify for a USDA loan.

If you’re buying a lot of land, look into U.S. Agriculture Loans.

8. Get a better rate by using escrow

Always have your lender set up an escrow account (most do it by default). You’ll pay monthly into the escrow account, which will pay your insurance and property taxes. It costs nothing but lenders give you a better interest rate if you use that service.

9. Learn the HP12C

Get an HP12C finance calculator (you can use the Android/iOS apps) and learn how to use it to calculate your payment or how much house you can afford (Or use the finance functions in MS Excel or Libre Calc).

How do you calculate your monthly housing expense?

For your total monthly cost estimate, consider these items:

- Mortgage. Principal + Interest. You can calculate this with the HP12C.

- PMI. (if you can’t put 20% down).

- Property Tax.

- HOA Fees.

- Pool maintenance.

- Home maintenance (budget 2% of the home value spent annually for a new house in good condition. 4% for an old house).

- Local taxes / school levies / mello-roos / mandatory inspection fees, etc.

- Utilities. Gas, water, sewer, electric, internet, trash.

- Home insurance (I like Amica, but they are not the cheapest).

- Protection fees (if you live in a gang area).

Learn your options, keep your mortgage terms flexible, and get local advice.

Debt from a Biblical Perspective

So, here are some wrong things people have told me the Bible says about debt:

- The Bible says debt is a sin. Where?

- The Bible says good debt (appreciating assets such as a house) is good while depreciating assets (such as a car) is a sin. I don’t see that in Scripture either.

However, some people can’t handle debt responsibly, there is wisdom and safety in avoiding debt, and there are some people whose conscience bothers them about debt. If your conscience bothers you, it would not be safe to take on debt.

There is also a risk that debt makes a comfortable life available before we’ve earned it, or causes us to be less creative in finding another solution. I think it best to use debt sparingly and wisely.

What does the Bible say about debt?

The borrower is the slave of the lender.

— Proverbs 22:7 LSB

While not prohibited, the Bible tells us that debt is a type of slavery. If you can save $50K annually, and you borrow $350K to buy a house, you’re selling yourself into slavery for 7-years. That’s an overly simplistic example that ignores interest, inflation, etc., but you get the idea.

The reason I don’t think this type of slavery for a house is a bad thing is that buying a house is a tradeoff from leasing or renting where you’d be paying that amount anyway.

Now, there are some who will say all debt is sinful. They’ll say you shouldn’t take on any debt. Not for a car (depreciating asset) or even for a house (appreciating). I don’t agree. There is a time and place to utilize debt. I have taken on debt to purchase both cars and houses. Here are two such examples where I believe the decision was wise:

- I originally purchased a used car with cash, but after the third time I had to call my boss with, “my car broke down; I’ll be late to work.”, I decided it was prudent to take out a loan to pay for a reliable vehicle than risk my job and reputation. It wasn’t from my lack of discipline that I didn’t have the funds to purchase a reliable car; I was just getting started in life. Even though it was a depreciating asset, having a reliable means of transportation meant I was dependable to my employer. But, I didn’t buy a ridiculous car; I bought something practical that I could pay off quickly.

- When Kris and I purchased our first house, it was barely more expensive to pay a mortgage than what we were paying to lease a small apartment. It was $1,250 a month for a 1-year lease on a 2-bedroom apartment in a cockroach-infested area which we’d have to renegotiate annually, versus $1,400 a month for a 30-year mortgage on a 4-bedroom house with no risk of price increases. The equity factor more than made up the difference–at the end of 30-years we’d own a house. I also did not engage a realtor until I consulted my friends, my parents, and one of the pastors at my church.

So while I won’t say don’t take on debt, I will say to seek counsel (as you already are), exercise prudence, and make sure that you have the means to pay for it.

Establish your work outside

And make it ready for yourself in the field;

And afterwards, you shall build your house.

— Proverbs 24:27 LSB

I’m hoping you find a good house!

If you need to take cash out in order to get a better rate, you also have the option of just putting all the cash back into the mortgage after the loan closes, and recasting to get a lower monthly payment. So that option has very little downside even if you don’t want to increase your loan balance and monthly payment. Unfortunately I realized that I could have done this only after closing on a refinance :-(

The ibonds trick is neat, but historically I think the rate is usually under mortgage rates (and also you need to hold them for 5 years to avoid penalty), so I don’t know how often you’d be able to use it long-term. Certainly now is a good time though!

Exactly, you can just pay it right back and still have the lower rate. I wish broker agents were aware of the breakpoints; even the best brokers I’ve had don’t seem to understand the mechanics of mortgages and just rely on what the computer tells them.

I was curious if I-Bonds would work historically. In the year 2000, I-Bonds were yielding 6.49% while mortgage rates were around 8%, so not worth it then.

Thanks, Ben! This has been very helpful in getting us started and we continue referencing back to it as we continue through the process. I like the added part about debt from a Biblical standpoint as well.

You’re welcome; thanks for suggesting the reply could be made into a blog post! The most important thing I learned is that it’s easier to write for an audience of one.