I found a project called StorJ. With it, you can “be the cloud” by renting out your spare NAS or hard drive storage. The consumer side is Tardigrade which allows people to store their data. It seems to be targeted at people looking for a decentralized version of Amazon AWS S3.

About Tardigrade

A few highlights of Tardigrade:

- Storage is $0.01/GB ($10/TB) .

- Uploads are free and downloads are $0.45/GB ($45/TB)

- All data on Storj Tardigrade is encrypted. No accidentally leaving an S3 bucket public.

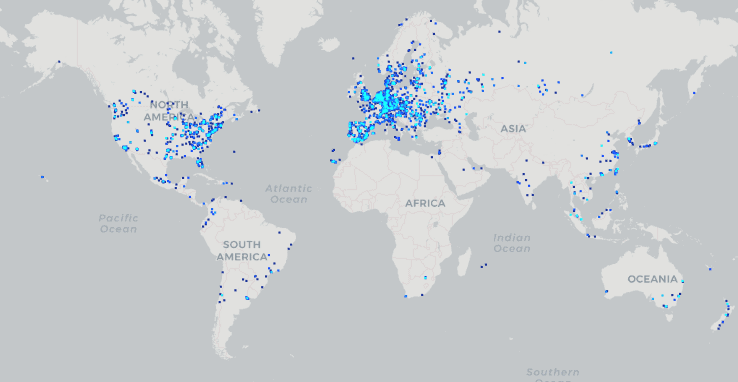

- Decentralized. Each piece of data is sent to 80 different StorJ hosts spread out across the world.

- Only 30 out of 80 nodes are required to re-assemble the data. This makes the StorJ network extremely resilient to faults and regional outages.

The service is priced lower than S3 so it can compete… sort of. This will be a tough market for Tardigrade… your enterprise customers are going to stick with the big 3: Amazon AWS S3, Azure Blob Storage, and Google Cloud Storage. And the pricing is higher than Backblaze B2 so it’s not targeting budget consumers either. The market where it could do well is for people specifically looking for decentralized storage with the performance and robustness of S3. Actually Tardigrade could end up being more resilient, but time will have to prove it.

StorJ Nodes – Decentralized Object Storage

The data on Tardigrade is stored on StorJ nodes all over the world.

Anyone can build a StorJ node and make money by selling their available hard drive space. StorJ nodes run on Docker and if configured per the documentation automatically keep themselves updated. You can install StorJ on anything from a Raspberry Pi with a USB drive attached, to a VM backed by ZFS storage running on FreeNAS/TrueNAS. The minimum requirements are:

- 99.3% uptime (you can be down 5 hours a month)

- At least 550GB of spare storage

- Internet with 25 down 5 up

- 2TB bandwidth available per month (easy to do on 25/5 if you don’t have data caps or throttling).

My StorJ Experiment and Earnings

In February 2020, I started up a StorJ node as an experiment. I offered up 3.5TB of data on a Proxmox VM. StorJ runs under Docker and automatically keeps itself updated. I hadn’t even looked at it until now and it is still running great.

It took just over 2 months for StorJ to fill up my 3.5TB node.

The payouts are in StorJ tokens which you can exchange for other cryptocurrencies such as Bitcoin, or convert it to USD if you’d like.

The node starts to earn StorJ tokens immediately but a percentage of token payments are held back for a certain number of months, and fully paid out back after 13-months. The reason for the holdback is to encourage nodes to stay online for a long time or to leave the network gracefully.

The earnings are calculated as:

- $1.5/TB/Month Storage

- $20/TB Egress

- $10/TB Repair/Audit (if you help repair data from another node going offline).

So, here are my results on 3.5TB for the last 8 months (I don’t know why it is above 3.5TB some months, maybe compression?)

| Month | Storage | Egress | Egress (Repair) | Paid Out | Withheld |

|---|---|---|---|---|---|

| March | 129GB | 266GB | $3.44 | $10.32 | |

| April | 1.9TB | 1.9GB | $2.75 | $6.98 | |

| May | 3.7TB | 19GB | $4.95 | $5.33 | |

| June | 3.5TB | 135GB | $4.04 | $4.53 | |

| July | 3.6TB | 596GB | 279GB | $10.03 | $10.03 |

| August | 3.6TB | 898GB | 589GB | $21.46 | $5.34 |

| September | 3.5TB | 247GB | 133GB | $8.46 | $3.45 |

| October | 3.6TB | 377GB | 197GB | $11.19 | $3.73 |

So, after 8 months my wallet says I have $93 USD worth of STORJ tokens, and $51 still held back. This behaves like a cryptocurrency so the value fluctuates against the USD. I’ve seen the value range from $77 to $96 within the last few days. You’ll notice I’ve only been paid out a total of $66, but have $93, that’s a result of the value of STORJ changing against the USD.

Profitability

NAS Hard Drives can be purchased around $20/TB. It looks like it may be possible to make that much per year selling the storage before other costs. So depending on your bandwidth, electricity costs, and hardware costs, probability of failure, and value of your time, it might be possible to turn a small profit.

Now, before you go out and buy Petabytes of storage to rent out, you should know this probably won’t scale well. It will take a long time for your node to fill up. Also, StorJ has to be resilient so it spreads out the data to different locations. I believe it counts all the nodes on the same /24 network as one node so if there’s another node with a public IP near yours it’s going to split the storage with your node.

Some people will be surprised at how difficult 99.3% uptime is. I can’t tell you how many times even businesses tell me, “We never go down.” All it takes is an event you didn’t plan for: a drive failure, ISP outage, extended power outage, bad PSU, fire, etc. During my 8-month test running StorJ, we had a 6-hour power outage after a storm. I was below the required 99.3% uptime requirement for at least one month. Fortunately, StorJ didn’t disqualify my node. But that’s enough downtime my node could have forfeited the withheld payouts.

All in all, this looks like a good project. If you have some spare storage on your NAS you’d like to rent out, you can sign up to be a node operator. Unlike most cryptocurrency mining projects, StorJ actually accomplishes something useful.

.

Update September 26, 2021: From March 2020 to August 2021 the total value of my StorJ tokens is $678. That’s 18 months so an average income of $37/month (this may be more than usual due to cryptocurrency price fluctuations). My StorJ node is storing 6.44TB out of the 24TB I gave it.

This is fantastic!

I can actually see the market: paranoid people who want secure, cheap cloud solutions. In our volatile age, privacy concerns are at fever-pitch, which is why Parler/MeWe are now on the social media map.

The one downside I see, though (and *please* call me a cynic if I’m being irrational) is the commoditization of cloud storage. It’ll become an “Uber-ization” of the market, driving prices down for consumers.

Not that I *want* it to fail. I just hope they have a solution for when the Big 3 notice and bump their prices down. A 0.06% profit margin is tenable for a massive corporation (though risky enough to make the management destroy all the underlings’ happiness) but smaller orgs can’t handle that much volatility.

Oh, and if you want to check it out, you may find use in shucking your hard drives:

https://www.ifixit.com/News/46724/how-to-find-useful-discounted-disks-inside-an-external-hard-drive

Ha! I did that when we had the big drive shortage in 2011!